We have devised a two-part article to cover all aspects of the Matarbari Deep Seaport comprehensively. Part 1 explores the potential of the Matarbari deep sea port and its possible impact on Bangladesh’s economy. Part 2 highlights the challenges of a mega project such as this detailing the possible pitfalls and operational hurdles that must be avoided to ensure its success.

With the development of the country’s first deep sea port, there is little doubt that Bangladesh is undergoing economic transformation by strengthening its trade connectivity with the rest of the world. Currently, under construction, the Matarbari deep-sea port holds immense strategic significance for Bangladesh. It promises to uplift the majority of connectivity challenges by reducing transportation costs as well as the required time, thereby vastly improving Bangladesh’s competitiveness in trade. Greater efficiency in maritime trade, which makes up 94% [1] of total foreign trade, is expected to stimulate robust economic growth with an expected addition of 2-3% [2] to the country’s GDP, generating many employment opportunities.

Located in the Moheshkhali sub-district of Cox’s Bazar, the project’s primary purpose was to provide maritime connectivity for the Matarbari coal plant which has been under construction since 2011. In 2018, the government of Bangladesh decided to transform the Matarbari port into a deep-sea port, estimated to be completed by January 2027. The projected cost of the deep-sea port is USD 1.5 bn [2] ( Tk 177.77 billion), with JICA extending USD 1.09 bn (Tk 128.93 billion), while the Bangladesh government and the Chittagong Port Authority cover the rest.

Bangladesh’s shipping and logistics sector has witnessed remarkable growth in recent years, reflecting the nation’s expanding trade activities. The country currently has two major sea ports – Chittagong and Mongla. Another port gaining momentum is the Payra Seaport in Patuakhali, which is expected to handle 3,000 TEUs once fully operational. The Chittagong Port is the national gateway. It handles 90% of the country’s international trade and about 98% of containers. The rest passes through the Mongla Port.

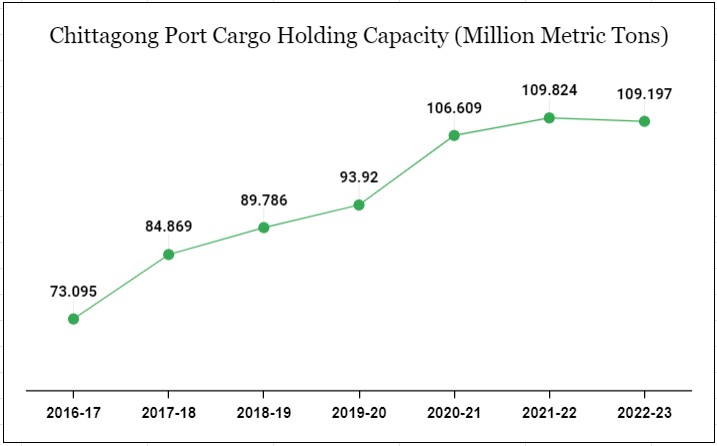

The capacity of the Chittagong port has surged from 2,926 TEUs (Twenty Foot Equivalent Units) in 2019 to about 4,000 TEUs by 2021, signaling a growth rate of nearly 36.7%.[3] In FY 2016-17, Chittagong port’s cargo holding capacity was 73.095 Million metric tons (mt), which increased to 109.197 Million mt in 2022-23. Currently, about 1,600 local and 20-30 international logistics and freight forwarding companies support the EXIM trade in Bangladesh. [3] Despite promising growth potential indicated by the increasing demand for port capacity, the shipping sector grapples with various challenges.

In the World Bank Logistics Index 2022, Bangladesh ranks 88th [4], positioned much lower than India (38th) and Sri Lanka (73rd). Although twelve spots higher than being ranked 100th in 2018, the notable gap shows that Bangladesh has massive room for improvement in its overall logistics scenario compared to its South-Asian peers. Analysis shows that there are two major hurdles faced by Bangladeshi seaports eroding their competitiveness outlined below:

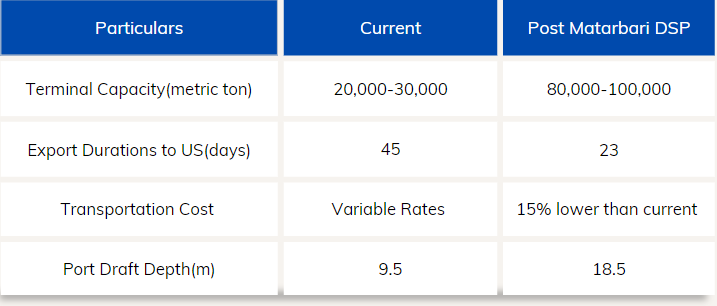

At present, Bangladesh heavily relies on feeder vessels for its import and export operations. Limitations in infrastructure in the Chittagong port jetty, such as the shallow depth of 9.5 meters [2] in draft and narrow width of 190 meters, restrict the entry of large mother vessels. This forces the mother vessels to offload cargo at transshipment hubs or deep-sea ports in neighboring countries like Sri Lanka, Singapore, and India. Such indirect arrangement increases time and cost for trade operations in Bangladesh, particularly in the case of exports destined for major markets like the USA, Canada, Europe, and Australia making it unfavorable to do business with the country. It also presents uncertainty risks since the country’s trade capabilities are perpetually dependent on the operating conditions in the foreign ports including fluctuations in shipping schedules, vessel capacities, etc.

The host countries’ overall economic and political stability may also impact the activity conducted at these ports which further adds to this risk. For instance, the suspension of operations at Colombo Port due to political and economic crises caused severe trade disruptions in Bangladesh in 2022 [5]. Local businessmen facing the full heat of such uncertainties explain that the absence of a deep seaport added to poor service at the port and customs office is slowly diminishing the country’s business [6] competitiveness and redirecting foreign investments towards other contending countries.

Berth congestion is one of the most critical problems driving up maritime trade costs. Currently, container ships bound for Chittagong Port face extended anchorage wait of 3 to 7 days due to overcrowding of ships waiting to dock at the port. To offset the expenses for extra fuel and staffing incurred during these delays, shipping lines initiated the collection of a “Congestion Surcharge” amounting to USD 150/TEU [7] from consignees and shippers starting in 2017.

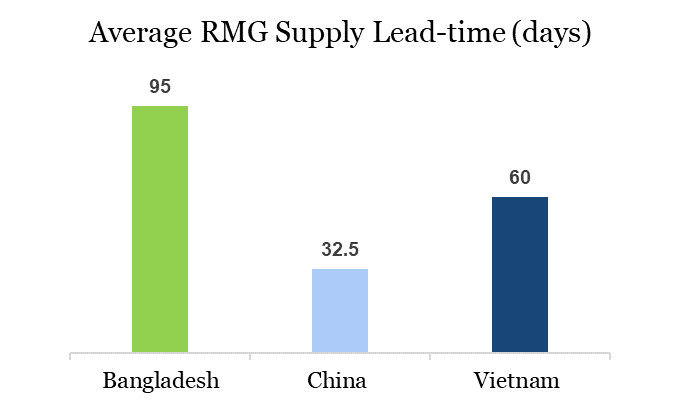

According to the World Bank’s 2021 Connecting to Thrive report, trading with distant economies like Brazil or Germany is 15–20 percent [8] cheaper for Indian companies than trading with counterparts in Bangladesh. The average RMG supply lead time is higher in Bangladesh (95 days), compared to its competitors Vietnam (60 days) and China (32.5 days). This disparity discourages global companies from engaging in trade with Bangladesh, adversely affecting the country’s import and export activities. Adding to the woe, the scarcity of feeder vessels often exacerbates the situation, prolonging the wait times for unloading goods and further escalating costs.

While the maritime trade of Bangladesh is fraught with various challenges, the vision of a deep sea port emerges as a beacon of hope for traders. If handled successfully, Matarbari deep sea port stands to become a significant strategic asset, poised to unlock new opportunities and catalyze growth for Bangladesh. Some of the advantages that this port is expected to present:

The Matarbari Deep Sea Port appears as a pivotal solution to the pressing capacity challenges by promising to expand vessel capacity, shorten transit times, and reduce costs — set to substantially bolster regional trade. The multipurpose terminal’s expected capacity to cater to large cargo vessels, capable of transporting 80,000 to 100,000 metric tons of goods [2], marks a considerable improvement from the current limit of only 20,000-30,000 metric tons. Analyzing the current trend, projections by Germany’s Hamburg Port Consulting paint a picture of remarkable growth in container handling for Bangladesh. Chittagong port is expected to manage 5.6 million TEU containers by 2036 [2] compared to 3.2 million TEU handled in 2022. Matarbari Deep Seaport also envisions handling a staggering 1.4 to 4.2 million TEU containers by 2041.

Furthermore, the new port indicates a heightened route efficiency, establishing a direct trade pathway to Europe and the US reducing export durations from Bangladesh to the US from 45 days to just 23 days. Previously there have been efforts made to initiate direct shipments to Europe but this was hindered by the insufficient depth at Chittagong, preventing larger ships from docking [9]. Insights from the Chittagong Port Authority also suggest that constructing a deeper port capable of accommodating larger vessels could potentially slash transportation costs by 15 percent.

Nestled close to the Bay of Bengal, where a significant portion of global trade converges, Matarbari Port is expected to serve as a prime hub for transshipment and trade. The Bay of Bengal holds pivotal importance for economic giants like China and Japan and Matarbari will act as a key access point for global shipping lines to reach beyond the sea. Its strategic location, near vital sea routes with promising prospects for resource exploration, makes it a focal point for geopolitical interests.

Although trade within the South Asian region has seen remarkable growth from USD 3 billion in 2005 to about USD 18 billion in 2019, regional trade potential remains largely untapped. The unexploited trade potential stands at 93% for Bangladesh, 9% for Bhutan, 50% for India, and 76% for Nepal [10]. Regional trade in South Asia accounts for only 5% of total trade, largely lagging behind East Asia and Sub-Saharan Africa where intraregional trade accounts for 50% and 22% of total trade, respectively.

The Matarbari port, situated right at the heart of South Asia, could facilitate realizing the optimum trade potential among these countries. India’s Seven Sisters, Myanmar, Nepal, and Bhutan have also shown interest in the Matarbari port, as it can help integrate these landlocked regions into the global value chain while generating considerable transit duty revenue for Bangladesh. Furthermore, strategically positioned between the Middle East and Northeast Asia, it also offers lucrative trade opportunities for ASEAN and Gulf countries.

The Matarbari deep-sea port is not just a standalone facility; it is a pivotal part of the government’s broader strategy to establish an industrial hub, demonstrating a holistic approach to economic growth. Adjacent to the port lies the bustling Moheshkhali Economic Zone, strategically positioned just 4 km away across a sprawling 3,500-acre expanse, offering ample investment opportunities. Additionally, Matarbari will be home to a coal jetty, an LNG terminal, and two coal-based power plants boasting a combined capacity of 1,200 MW, expected to begin partial operations this year. With nearby industries clamoring for reliable power, these plants will enhance operational efficiency.

Moreover, plans to link the Matarbari deep-sea port with the national railway network via a new 26-km railway track underscore the government’s commitment to enriching connectivity [11]. Importing raw materials for manufacturing will become more accessible by leveraging the port’s proximity to the manufacturing facilities while exporting finished products will benefit from streamlined logistics via Matarbari. The synergy from this integrated plan will fuel the creation of potential job opportunities.

As Bangladesh prepares to graduate from Least Developed Country (LDC) status, it faces significant challenges like an 11% reduction in exports, approximately USD 6 billion due to the loss of preferential market access [10]. To address this, taking strategic initiatives is crucial to mitigate drawbacks and strengthen regional importance. Given Bangladesh’s strategic location, the Matarbari deep-sea port project has the potential to be a key diplomatic asset that can solidify regional cooperation and global economic presence.

For instance, the project may favor Bangladesh’s negotiation plan in the potential trilateral cooperation agreement under the already operational India-Japan Comprehensive Economic Partnership Agreements (CEPA), besides offering promising avenues for trade and investment expansion. By facilitating trade flows and connectivity, the port will strengthen diplomatic relations and smoothen the transition toward developed country status by 2041, while mitigating challenges associated with LDC graduation.

It is evident that the Matarbari deep sea port is expected to have a significant contribution to the entire South Asian region through its transformation into a regional trade and commerce hub. However, it is crucial to acknowledge the major pitfalls of a billion-dollar mega project by learning from similar initiatives and addressing ancillary bottlenecks without which the outcome of the mega-project may remain fruitless. The challenges and potential obstacles to success are comprehensively discussed in the next part of the article.

Key Takeaways:

Read Part 2-Mitigating Risks for Matarbari DSP: Drawing Insights from Hambantota Port

This article was authored by Nishat Binte Mohiuddin, Business Consultant, and Rahnuma Tasnim, Junior Associate at LightCastle Partners. Advisory support was provided by Zahedul Amin, Director at LightCastle Partners.

References:

Gain perspectives of the emerging sectors of Bangladesh

InsightsContact us for a comprehensive understanding of the investment landscape in Bangladesh