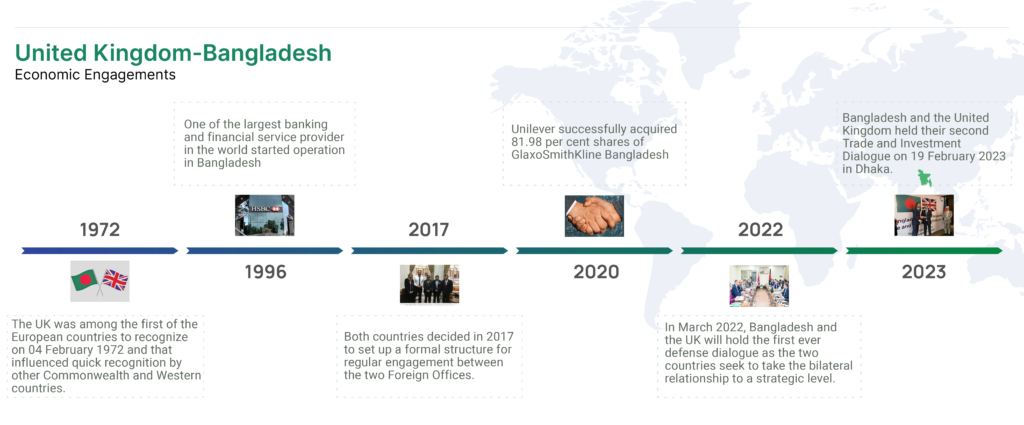

Following its recognition of Bangladesh on February 4, 1972, the United Kingdom has assumed a crucial role in shaping both the economic and diplomatic landscapes of this South Asian nation. This prompt acknowledgment by the UK has had a cascading effect, spurring other Commonwealth and Western nations to do the same.

A mere two months later, in April 1972, Bangladesh further solidified its global status by becoming a member of the Commonwealth, thereby reinforcing its connections with not only the UK but also the broader international community. This interdependence on an economic level has not only bolstered the economies of both countries but has also laid the groundwork for more extensive collaboration.

Moreover, the United Kingdom has emerged as a significant source of remittances, currently ranking as the fourth-largest contributor. As of 2022, remittance inflow had reached a notable USD 2.03 billion.

The cumulative aid extended by the United Kingdom to Bangladesh since its inception amounts to approximately GBP 3 billion. The commendable progress in development has served as a motivating factor for the UK to consistently augment its Official Development Assistance (ODA) to Bangladesh via the Foreign, Commonwealth & Development Office (FCDO).

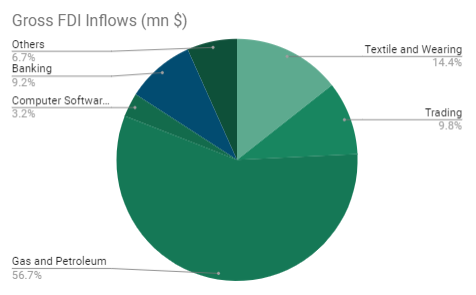

In 2022, the net Foreign Direct Investment (FDI) inflow reached a significant $560 million, positioning the UK as the most prominent contributor to FDI in Bangladesh. Predominant sectors of British investment in Bangladesh encompass energy, power generation, oil and gas, tea gardens, as well as financial and various service industries.

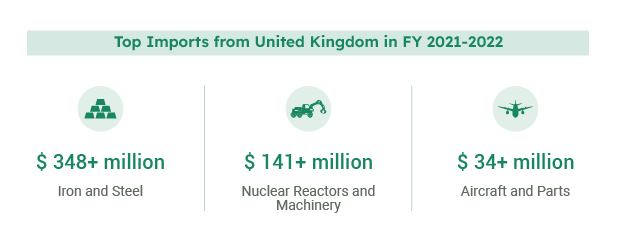

Ranked as the third-largest singular recipient of Bangladesh’s exports, the UK follows the United States and Germany, with the export value amounting to $2815 million in 2022. This figure represents a 9.2% share of the total export composition. The primary commodities exchanged predominantly encompass ready-made garments. Additionally, Bangladesh exports a diverse array of goods to the UK, ranging from knitwear, woven garments, shrimp, home textiles, bicycles, light engineering products, vegetables, frozen fish, ceramic tableware, to jute yarn and jute goods. On the import side, the UK supplies power-generating and industrial machinery and equipment, professional and scientific gear, textile fibers, home textiles, and ceramics.

In 2001, the EU-Bangladesh cooperation agreement was inked, serving as the cornerstone for trade interactions. This accord granted duty-free access to the European Union market through the Everything But Arms (EBA) initiative. This particular facet holds particular significance for Bangladesh’s exports of garments, providing a notable avenue for trade growth and development.

On the import front, Bangladesh’s payments to Korea for FY 21-22 totaled around $1.5 billion. Key imports encompassed Ships, Boats & Floaters, Nuclear Equipment, and Plastics and Articles thereof, and Iron & Steel.

This alliance is further aided as the Government of Bangladesh (GoB) has instituted liberal investment and business operation policies regarding taxation, import duties, work documentation, and capital repatriation, among others, as such that it encourages further foreign investment in the secondary and tertiary sector of the country.

One such policy is the Bilateral signatories of Double Tax Avoidance (DTA) agreements. This agreement is endorsed by the United Kingdom as well- creating more opportunities for investment. Furthermore, during the most recent Strategic Dialogue held in 2023, the UK reaffirmed its dedication to extending duty-free and quota-free entry to the UK market, a commitment set to endure until 2029. Additionally, once Bangladesh transitions out of the Least Developed Country (LDC) category, it will gain access to duty-free export privileges for approximately 92% of tariff line items, including products like ready-made garments (RMG), when exporting to the UK market.

Contact us for a comprehensive understanding of the investment landscape in Bangladesh