The concept of value investing, popularized by Warren Buffett, focuses on buying high-quality investment businesses at prices below their intrinsic value and holding them for the long term. Value investors avoid media hype, focusing instead on fundamentals, and often view panic as a buying opportunity.

The recent ouster of Prime Minister Sheikh Hasina on August 5, 2024, after 15 years in power, might cause concern for some investors. However, a value-based investing mindset suggests that now is the time to invest in Bangladesh. Here are five key reasons:

1. Bangladesh’s Economic Fundamentals Remain Strong

Bangladesh is one of Asia’s most dynamic economies, with HSBC projecting it to become the world’s 26th largest economy in the next decade. Often referred to as the next “Asian Tiger,” Bangladesh has drawn comparisons to the rapid economic development of South Korea, Singapore, and Taiwan.

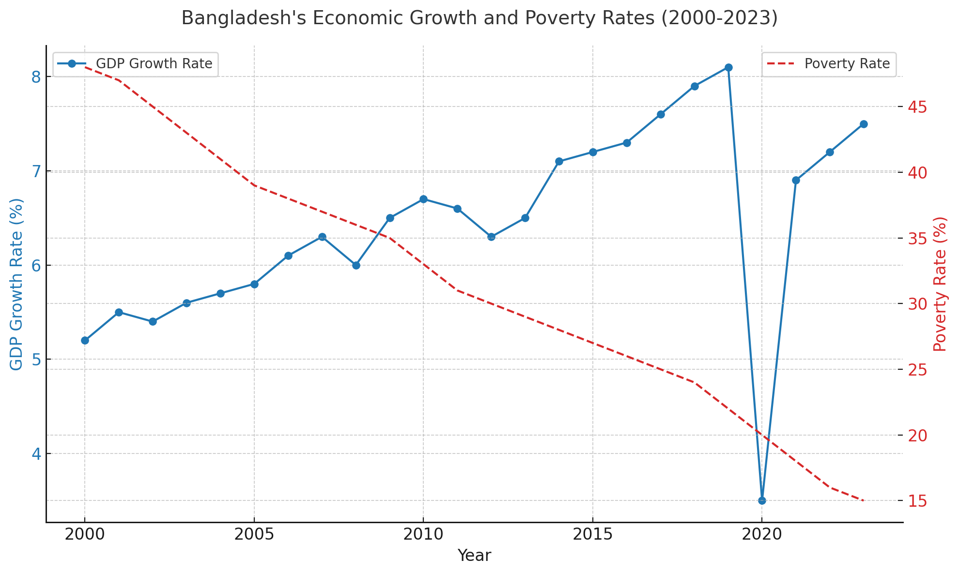

- Fast Economic Growth: Bangladesh has consistently achieved growth rates exceeding 6-7% annually, ranking among the fastest-growing economies globally. Its GDP per capita has even surpassed that of India. This growth is driven by strong exports and rising consumer demand, making Bangladesh one of the top 10 consumer markets in the world.

- Economic Diversification: While Bangladesh is well-known for its robust ready-made garment (RMG) industry, it is also diversifying into sectors such as pharmaceuticals, electronics, shipbuilding, and agro-processing.

- Young Population: Over half of Bangladesh’s population is under 25, offering a “demographic dividend.” Investments in education and skills development are creating a more competitive workforce.

- Poverty Reduction: Between 2000 and 2020, Bangladesh halved its poverty rate. Today, less than 10% of the population lives in extreme poverty, and the country outperforms its regional peers on many social development indicators, including healthcare and education.

Bangladesh has grown faster over a longer period of time than even China. World Bank data

2. Commitment to Reform and Anti-Corruption

The ouster of Sheikh Hasina was largely driven by a student revolution, revealing deep frustrations with corruption and cronyism. However, the caretaker government, composed of prominent student leaders, is already pushing for significant reforms.

- Market Reaction: Following Hasina’s resignation, the stock market index rose by 13% in just three days, and the exchange rate of the USD depreciated by 6%.

- Reform Agenda: The new government is focused on banking sector reforms, tightening anti-money laundering measures, and enhancing the transparency of financial institutions.

- Global Support: International organizations, including the World Bank and the IMF, have pledged support for Bangladesh’s reform agenda. The World Bank has already committed $2 billion to assist the government in this endeavor.

3. Bangladesh’s Economy Is Too Big to Ignore

With a GDP of approximately $450 billion, Bangladesh’s economy is expected to surpass $750 billion by 2029. Its growing market size positions Bangladesh as a major player in the global economy.

- Future Projections: HSBC forecasts that Bangladesh will be the 26th largest economy by 2030, while PwC predicts it will be among the fastest-growing economies, potentially becoming the 28th largest by the same year.

4. Instability Creates Opportunity

Periods of perceived instability can create mispricing in the market. Savvy investors recognize this as an opportunity to enter at lower valuations, especially when long-term fundamentals remain intact.

- Opportunistic Investment: Misconceptions about instability have led to undervalued assets in Bangladesh, creating a unique entry point for investors.

- Lessons from History: Much like India in the early 2000s, Bangladesh is poised for growth. Those who invest now will be well-positioned to benefit as the country stabilizes and reforms take hold.

5. Managing Risk in Emerging Markets

Emerging markets always come with some level of risk, but informed investors see Bangladesh as less risky than comparable economies such as Egypt, Nigeria, and Pakistan. Despite recent political changes, Bangladesh remains a relatively stable market with strong growth prospects.

- Long-Term Play: Investors who take a long-term view will find Bangladesh’s market ripe for opportunity, especially as reforms create a more transparent and stable investment environment.

- New Leadership: Nobel laureate Professor Mohammad Yunus, now heading the interim government, brings global goodwill, deep knowledge of Bangladesh’s microeconomics, and a commitment to fostering positive change.

In uncertain times, value-based investors know that opportunities are often greatest. Bangladesh, with its strong fundamentals and commitment to reform, presents an attractive investment destination. The time to act is now.

Source: The Forbes Magazine